🌯Inclusive FinTech Knowledge Bites [Week #59]

Ghana’s Affinity NeoBank's with an agent-led strategy, Mpesa's 67% reversal reduction with simple UX, and Kenyan LUSOBE’s interest-free student loan innovation.

Hey,

I’m Hugo Pacheco, and this is The Barefoot Economist —a newsletter where, every week, I break down three essential stories on last-mile technology, emerging market innovation, and financial inclusion. Consider it your bite-sized takeaway to stay informed—sharp, insightful, and easy to digest.

This week on The Barefoot Economist:

📲 Ghana’s Affinity NeoBank witth an Agent-led Strategy

✅ From Oops to Trust: Mpesa reduces daily reversal requests by 67%

💡 Interest-Free Innovation: How LUSOBE is Rethinking Student Loans

Enjoy your reading!

💰 Ghana’s Affinity Lands $8M to Transform Banking in a Mobile Money-Driven Economy

Digital banking’s slick interface might grab attention, but let’s keep it short: tech alone won’t win hearts or build trust. Here’s the brutal truth—if you’re serious about growth, you need a hybrid model that marries digital efficiency with a genuine human touch.

Since launching last October, Affinity has onboarded over 50,000 customers, and 65% have never dabbled in formal banking. That’s not a fluke—it’s proof that people crave guidance when stepping into the digital unknown.

More than 60% of these newcomers are women in the informal sector, showing that when you mix high-tech with a real-life connection, you break down barriers and build inclusion.

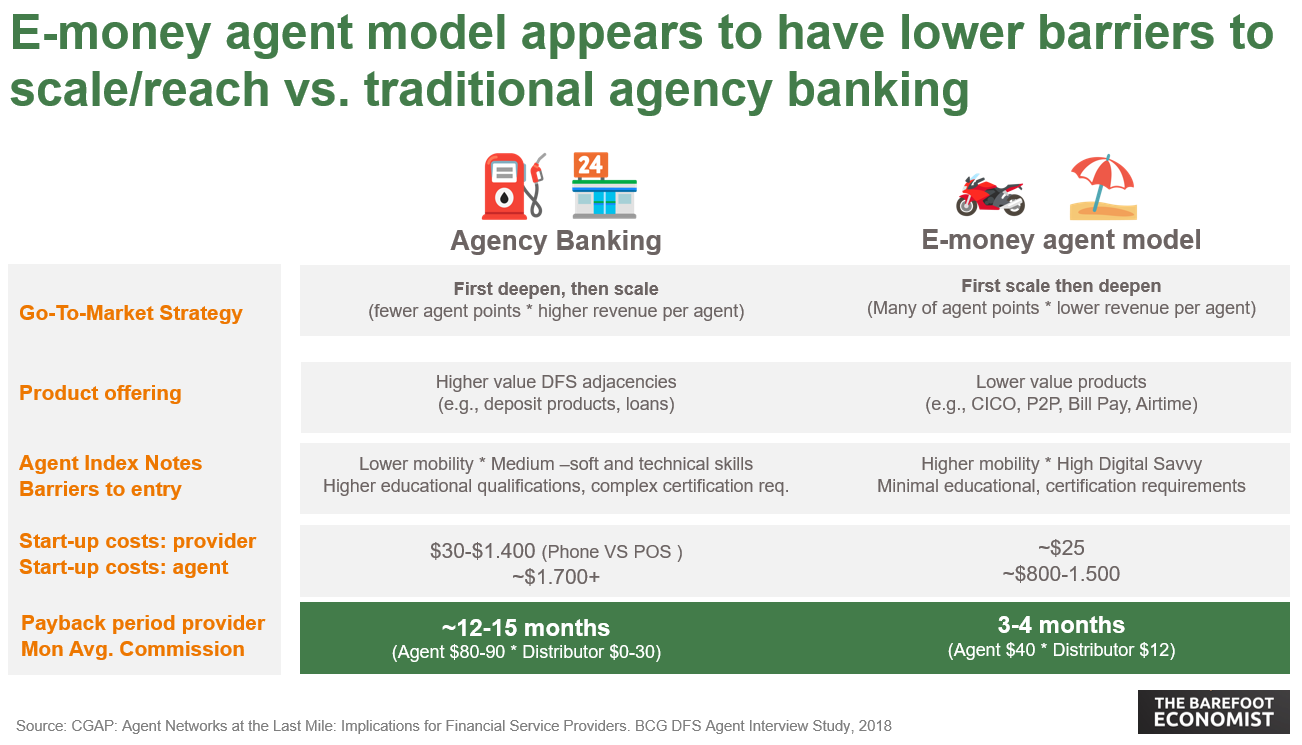

While mobile money top-ups drive nearly 90% of deposit inflows and loans account for over 90% of revenue, the magic lies in the hybrid approach. With 26,000 customers onboarding via a trusted agent network and 55% of those later transitioning to full digital usage, it’s crystal clear: people want convenience, but they also need someone to show them the ropes.

In short, if you think a flashy app alone is enough, you’re selling yourself short. The future of banking is about blending digital agility with that irreplaceable human element—because nothing beats a real conversation regarding trust and understanding. Get this right, and you’re not just in the game; you’re setting the pace.

🔥 Seeking transformative change? My monthly fractional role is reserved for just 8-10 companies annually, offering high-level strategic advisory, go-to-market planning, and growth acceleration. If you’re ready for serious impact, let’s chat — Only 4 spots left!