🌯Inclusive FinTech Knowledge Bites [Week #51]

CBN's cashout limits drive to higher PoS agent fees, Ethiopia's scalable ID strategy for financial inclusion, and India Post's new IFS Portal for remittances

This week on The Barefoot Economist:

💸 CBN’s Withdrawal Limits Push PoS Agents to Hike Fees

🆔 Ethiopia’s Identity Playbook for Financial Inclusion at Scale

📯 India Post Financial Services launches IFS Portal for Remitances

Enjoy your reading!

Hugo Pacheco, The Barefoot Economist

💸 CBN’s Withdrawal Limits Push PoS Agents to Hike Fees: What It Means for Nigerians

PoS withdrawal charges in Nigeria have increased due to cash scarcity, higher costs, and the introduction of an electronic money transfer levy. PoS agents have been struggling to get cash from banks, leading to increased costs that are passed on to the end users, drawing customer complaints and reduced patronage in some cases. The future of Nigeria’s PoS ecosystem depends on striking a balance between ensuring cash availability and fostering a transition to digital payments, posing a challenge for policymakers in shaping the country’s financial services landscape. Key points include:

Current PoS Withdrawal Charges Across NigeriaVariability by Location: Withdrawal fees differ significantly across regions. For instance, in Lagos, charges for withdrawing ₦5,000 range from ₦100 to ₦200, depending on the area and agent.

Higher Withdrawal Amounts: Withdrawing larger sums, such as ₦100,000, can attract fees up to ₦3,000.

Factors Influencing Increased ChargesCBN Withdrawal Limits: The Central Bank of Nigeria (CBN) has set a daily limit of ₦1.2 million per PoS agent and capped individual withdrawals at ₦100,000. These restrictions have led agents to adjust their fees to maintain profitability.

Electronic Money Transfer Levy: The introduction of a ₦50 levy on electronic transfers has increased operational costs for PoS agents, contributing to higher withdrawal fees.

Impact on Customers and Financial InclusionCustomer Dissatisfaction: The rise in withdrawal charges has led to frustration among customers, especially those in need of quick cash access.

Financial Inclusion Challenges: Higher fees may deter low-income individuals from using PoS services, potentially hindering financial inclusion efforts in underserved communities.

Strategic Considerations for StakeholdersRegulatory Oversight: There is a pressing need for the CBN to regulate PoS withdrawal fees to prevent exorbitant charges and protect consumers.

Support for PoS Agents: Providing PoS agents with better access to cash and reducing operational levies can help stabilise withdrawal fees and ensure the sustainability of their services.

🌯 The Barefoot Insight

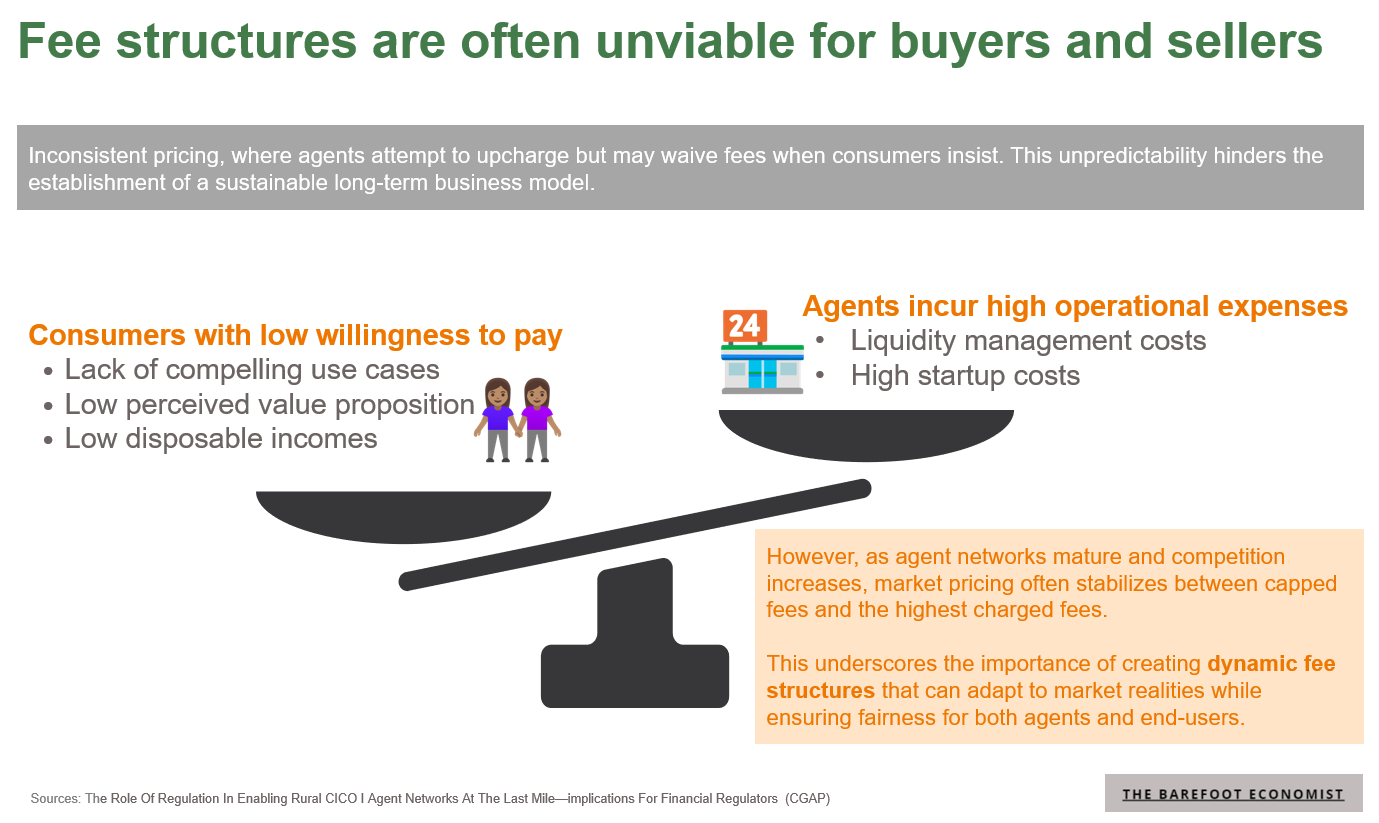

A key insight from Nigeria shows that, despite fee caps, 60% of agents resort to upcharging customers to stay afloat, which provides a 22% margin lift.

However, as agent networks mature and competition increases, market pricing often stabilises between capped fees and the highest charged fees. This underscores the importance of creating dynamic fee structures that can adapt to market realities while ensuring fairness for both agents and end-users.

Additionally, targeted solutions like:

Subsidizing rural operations through urban profits,

Supporting float logistics via runners or digital tools, and

Expanding agent offerings beyond cash-in/cash-out to include compelling use cases

By increasing the integration of digital payment solutions, PoS agents are central to the growth of Nigeria’s digital economy. They bridge the gap between the largely cash-based economy and the increasing shift towards cashless transactions. This integration not only boosts financial inclusion but also accelerates the adoption of mobile wallets and other digital financial services. Their role is pivotal in driving a more seamless transition to digital financial ecosystems, which can lead to greater economic stability and inclusion.