🌯Inclusive FinTech Knowledge Bites [Week #70]

Discover how Africa’s youth are reshaping financial access, the real infrastructure behind fintech growth, and how it all inspired Chime’s IPO

Hey,

I’m Hugo Pacheco, and this is The Barefoot Economist, a newsletter where, every week, I break down three essential stories on last-mile technology, emerging market innovation, and financial inclusion. Consider it your bite-sized takeaway to stay informed, sharp, insightful, and easy to digest.

This week on The Barefoot Economist:

📱 Banked by a Phone: How Africa’s Youth Rewire Financial Access

🧱 From Cowries to Cash-In: The Backbone of African Finance

🔁 Reverse Innovation: How African Fintech Inspired Chime

Enjoy your reading!

📱 Banked by a Phone: How Africa’s Youth Are Rewiring Financial Access

Africa’s youth are 70% of the population in Sub-Saharan Africa, yet only 4 in 10 have access to financial services, a missed economic opportunity. But they’re not waiting around. Young people are embracing tech, mobile money, and informal financial tools to carve out opportunities where institutions have failed. Digital finance, combined with strategic non-financial support, can unlock a new generation of entrepreneurs. What’s needed? Less top-down training, more embedded, contextual, tech-enabled solutions that fit into real life.

🌯 The Barefoot Insight

Barriers Are Real, But So Is the Youth DriveOnly 40% of youth in Sub-Saharan Africa are financially included.

Barriers include: lack of ID documents, regulatory gaps, limited tailored products, and cultural resistance.

Yet, youth remain proactive, leveraging mobile and informal tools to access finance.

📱 Digital Is the Default for YouthIn countries like Uganda and Senegal, mobile money outpaces traditional bank accounts among youth.

Uganda: 51% mobile vs. 29% banked

Senegal: 27% mobile vs. 13% banked

Over 618 active tech hubs across Africa support this shift toward digital entrepreneurship.

🔧 Tech Can Do More Than Just Digitize TransactionsExample: SmartPocket by OBUL in Uganda lets youth open accounts using just a phone number.

Tools like M-Shwari in Kenya enable micro-savings and instant micro-loans via M-PESA.

Digital solutions must bundle non-financial services like mentorship, training, and data dashboards (e.g., OZÉ + Ecobank Ghana collaboration).

🧠 Financial Education Alone Isn’t EnoughMeta-analysis reveals that traditional financial education fails to deliver impact.

What works better:

Using teachable moments (e.g., first income, business launch)

Peer-led models and parental influence

Designing for emotional and contextual relevance not just rational utility

💼 Design Products With Youth in MindMSC suggests FSPs should design products using 5 dimensions of value:

Functional | E.g.: Provision of services or products in the grocery store or market. A fast network’s use for fast transactions and perceived ease of use

Economic | E.g., giving periodic discounts or promotional prices

Humanistic | E.g., Provision of good employee-to-customer interaction, such as friendly greetings. Giving fair and non-discriminatory treatment

Social | E.g.: Provision of excellent customer experience that leads to word-of-mouth between existing and potential customers

Mechanic | E.g.: Setting convenient operating hours and transaction processes. Creation of user-friendly UX for mobile or web apps

Embed services at trusted touchpoints: schools, youth groups, family networks.

🌱 Alternative Finance Is Growing But RiskyCrowdfunding and P2P lending give access without collateral, but come with risks:

Unregulated environments

Fraud potential

No recourse for defaults

Platforms must balance access and protection to avoid financial harm.

Young people don’t just need products, they need platforms to build with you. The future of financial inclusion lies in co-creating solutions that reflect youth realities, embedding those into daily life, and letting youth shape the tools they use. From agent networks to smart APIs, the delivery mechanism matters as much as the product itself.

🧱 From Cowries to Cash-In: The Real Backbone of African Fintech

The story of fintech in Africa didn’t start with M-Pesa. And it sure didn’t start with code. It started with people, market women, roaming traders, shopkeepers, uncles with a lockbox, and the young man at the kiosk who knew everyone’s nickname and lent you 200 shillings when your child had malaria. These were and still are the nodes in Africa’s original financial system: the human agent network.

What most "roots of fintech" retrospectives miss is this: innovation in African finance doesn’t move in straight lines. It hops, adapts, and embeds itself into the cracks left behind by colonial exclusion, post-independence bureaucracy, and modern-day infrastructural inertia.

So let’s complete the picture.

🌯 The Barefoot Insight

The original piece nicely tracks the lineage from pre-colonial currency to post-colonial banks and mobile money, but it skips the messy, brilliant mechanics that got finance into the hands of everyday Africans.

Human Agent Networks as Linchpins:From village elders tallying cowrie counts to today’s licensed mobile‑money agents, human intermediaries have been, and remain, the vital conduits of trust and liquidity in retail banking distribution across Africa.

Branches don’t scale. Apps don’t teach trust. Agents do both.

Today’s fintech story is inseparable from the tens of thousands of human agents, retailers, airtime sellers,and market vendors who built the muscle memory for digital finance, one cash-in at a time. M-Pesa scaled not because it was clever, but because Safaricom deployed over 200,000 agents who lived where people lived, spoke the language, and extended informal credit when float ran dry.

Trust Was Never DigitalDigital infrastructure matters, but cultural infrastructure trumps it.

Pre-colonial financial systems worked because people trusted people, not abstract institutions. That logic never disappeared. What fintech did, at its best, was digitise trust relationships. An agent network is not just a distribution model. It’s a social compact. And too many digital-first fintechs forget this at their peril.

Market-Creating Innovation Is Distribution InnovationAfrica doesn’t need more banks. It needs better bridges between value and velocity. Real innovation here isn’t building a neobank UI, it’s figuring out how to make $1 transactions viable at scale. M-Pesa, Esoko, Moniepoint, and Chipper Cash didn’t “disrupt” anything. They built new markets by compressing distribution costs through smart agent architecture and regulation that allowed low-tier agents to onboard users, move cash, and settle transactions.

Regulators: The Unsung ArchitectsIt’s fashionable to blame regulators. But in Africa, smart regulatory moves, like allowing non-bank agents or tiered KYC, unlocked the most inclusive growth. BCEAO’s framework letting non-banks issue e-money? A quiet revolution. Nigeria’s SANEF agent model? Clumsy, but critical. Good regulation doesn’t chase innovation. It builds the guardrails to make market-creating distribution possible at the bottom of the pyramid.

Rural Reach Needs a Different Mental ModelDigital-only banking assumes data, signal, and smartphones. But cash economies need human interpreters: someone who can convert digital value into informal liquidity. Agents extend reach, reduce friction, and explain things. Fintechs that ignore this, especially in rural or peri-urban zones, are building castles on sand.

Fintech in Africa has earned its first victory lap, but the real test is coming. The next wave isn’t about payments. It’s about ecosystems.

Credit, savings, insurance, inventory, and identity will only scale if agent networks evolve from cash-handlers to relationship managers. AI and APIs won’t replace them. They’ll augment them, predict float demand, validate micro-creditworthiness, and flag churn risk.

This isn’t nostalgic. It’s strategic because infrastructure in Africa has always been part software, part sandal leather.

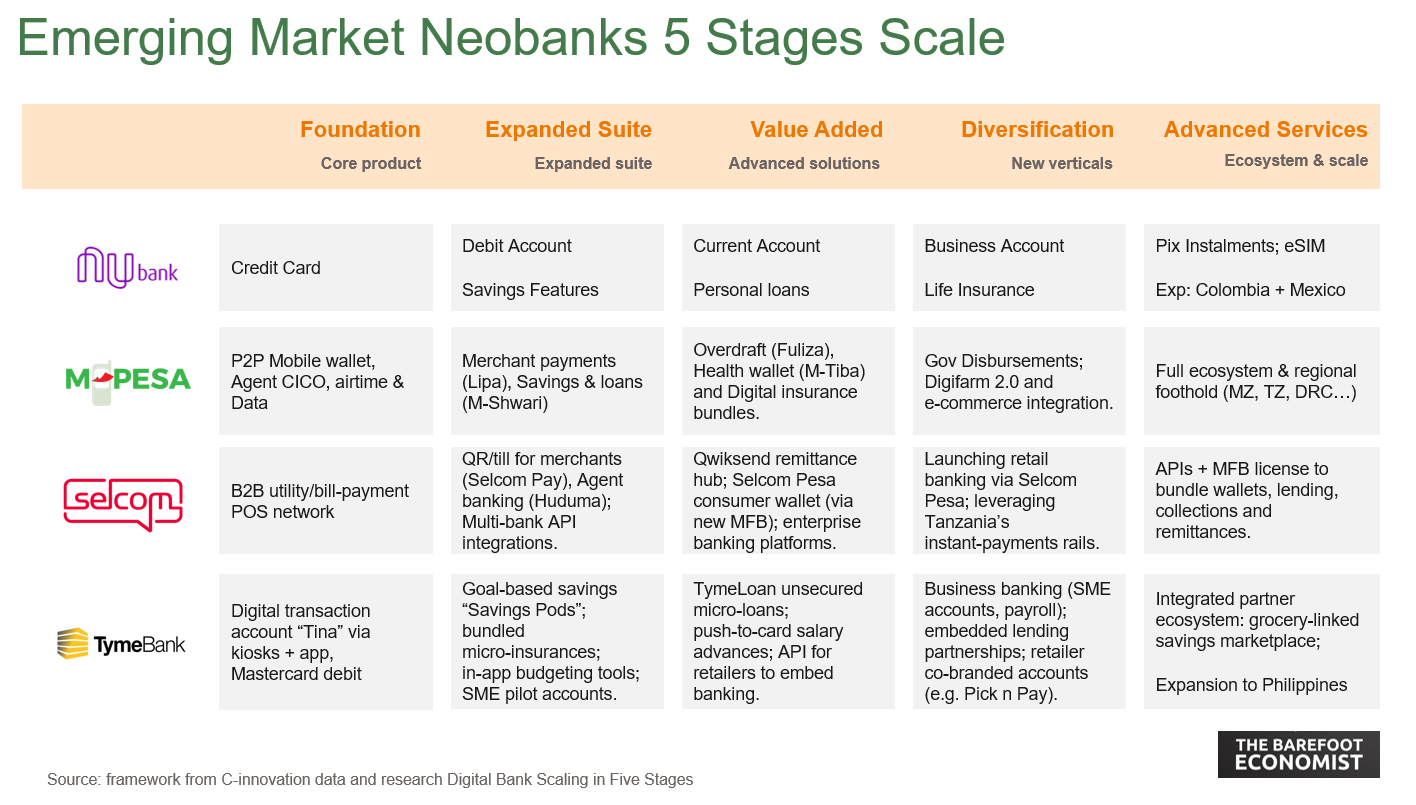

🔁 Reverse Innovation: How African Fintech Inspired a $40B U.S. IPO

Forget the fairy tale of Chime as a classic Silicon Valley breakout. Its real edge? Reverse geo-arbitrage. Global patterns, Brazil, Russia, Korea, gave savvy investors like Alexandre Lazarow the conviction that Chime’s no-fee, debit-first model could win in the dysfunctional U.S. banking market. By studying what worked in chaotic markets abroad, Chime built a tailored, trust-first bank for America’s financially fragile and turned every swipe into profit, thanks to smart regulatory arbitrage.

🌯 The Barefoot Insight

What Chime did in the U.S., turning overdraft frustration into trust and loyalty, was a great example of localising global fintech patterns. But in East Africa, the base layer was already strong: mobile money was the original killer product. Payments, storage, and even micro-services had scale before “neobank” became a buzzword.

Chime Didn’t Invent the Model. It Localized It.Brazil’s Nubank used credit to win. Korea’s Toss built a superapp. Russia’s Tinkoff scaled digital-first. Each operated in fragmented, low-trust markets, just like millions of U.S. households that Chime targeted. The insight? Trust and simplicity scale everywhere, if localised correctly.

Reverse Geo-Arbitrage = Pattern Recognition with TeethInvestors often export Silicon Valley models outward. Chime is proof that importing global fintech patterns inward is just as powerful, if you know what you’re looking for.

Debit Was the Wedge. Trust Was the Strategy.Where others leaned on fancy features, Chime banked on early wage access, no fees, and transparency. It didn’t upsell, it showed up. SpotMe wasn’t just a feature; it was a signal: “We’ve got your back.”

Durbin Loophole = Profit on Every SwipeChime hacked the U.S. system. Partnered with under-$10B banks to stay exempt from interchange fee caps. That’s not luck, that’s smart regulatory navigation, designed to reward usage, not punishment.

Don’t Copy. Translate.The takeaway for builders and investors: global models aren’t blueprints. They’re scaffolding. Chime didn’t clone Nubank; it interpreted the signal: underserved users, tired of being punished for being poor, want dignity and ease.

The Innovation Supply Chain is Global NowInnovation doesn’t trickle down from Palo Alto. Sometimes it surges from Lagos, São Paulo, or Seoul. The smartest bets come from watching where pain points are biggest, and solved first.

The real frontier now? Credit.

SME credit remains massively underserved, not just in Africa, but in the West too. That’s the opportunity. The models being built in EA (like Flow, Pezesha, and others) are already showing that data-driven, high-frequency underwriting can work for informal and small enterprises.

It’s a reminder: the fintech innovation supply chain isn’t one-way.

See you next week, or let's chat!

Hugo Pacheco