🕵️♂️ Behavioural Economics : How Agent Networks Humanize Financial Inclusion

Applying Behavioural Economics lens in Financial Inclusion

Behavioural economics blends insights from psychology and economics to understand how people make decisions in the real world, not in ideal, rational conditions. Unlike traditional models that assume individuals act purely in self-interest with full information, behavioural economics acknowledges biases, emotions, habits, and social influences.

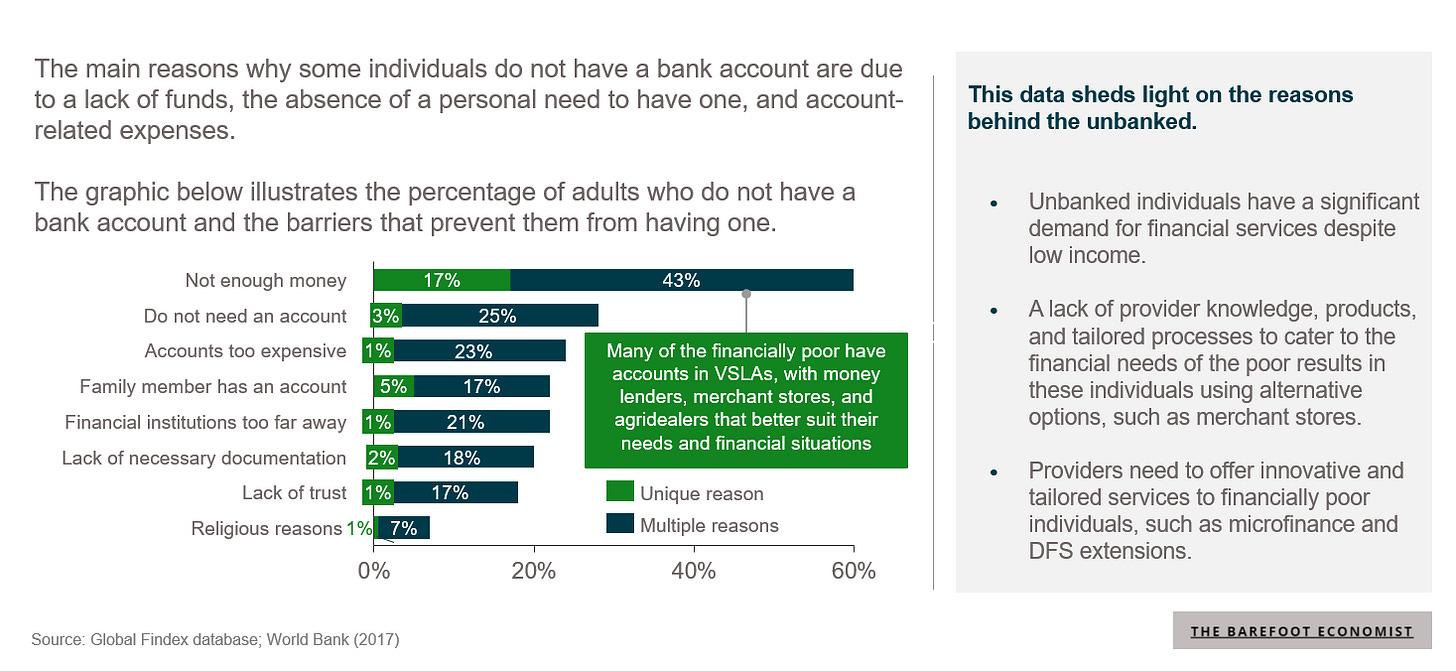

In the context of financial inclusion, this perspective is essential. Why do people avoid free bank accounts? Why do they prefer informal saving groups over secure digital wallets? Why do costly cash-outs feel safer than seamless transfers? Understanding the “why” behind financial behaviour is vital to designing interventions that truly work for underserved populations.

For disruptive innovations in financial services to succeed, especially in low-income, low-connectivity environments, they must go beyond digital infrastructure and focus on distribution and value proposition stickiness.

They must also engage with the human side of technology adoption. This is where agent networks shine.

Africa’s financial landscape is rapidly evolving, yet millions remain unbanked and underserved. While digital channels promise unprecedented scale, their effectiveness falters when infrastructure, literacy, and trust break down.

One of the big lessons from behavioral economics is that we make decisions as a funtion of the environment that we’re in. - Dan Ariely

Agent networks—local shops, kiosks, and mobile money agents—offer a complementary bridge, harnessing behavioural insights to drive real adoption. Below, we explore six of

’s behavioural-economic principles to explain why agents are indispensable and contrast this with the painful realities of digital-only approaches.